Superior Tradelines is a company that involves in improving the credit score of its clients. With the help of tradelines, clients problems can be resolved. These tradelines act as a broker between the people who wish to sell their credit. The company hooks them with people seeking to buy credit to improve their credit score. Hence, the company rents out the tradelines to buyers that want to boost their credit score.

This is carried out by granting an entry to an existing tradeline with a much better credit score. So individuals who do not have a good score can rent a tradeline. Companies like Superior Tradelines enjoy the benefits of a good credit score.

In this Superior Tradelines review, we check if the customers should choose this company. And if they choose this company, does that improve their creditworthiness? Also, how can a tradeline help individuals with their credit scores?

Why is a Credit Score Vital?

The credit score is vital when the individual is looking to make a large investment. This would entail a higher interest rate if they do not have a good credit rating.

When a person needs a much better credit rating, renting out a tradeline from a company with a good credit score. This would impact the individual’s credit score in a positive way. It would also aid him with a lower interest rate as compared to before.

On occasions where people are looking for viable solutions to protect them from a higher interest in their investment, tradelines offer a way for them to improve their credit score.

Companies like Superior Tradelines have authorized accounts with a higher credit rating. They are offering those accounts to people who are in need to ease their credit. The accounts offered by the tradeline are trustworthy. This is because the account owners have kept tradelines in a good position for a long time.

Can Superior Tradelines Be Trusted?

The Superior Tradelines website can be of some help, but not much information is available on it. The last post on the website is from late 2019, which shows that the website is not updated on a regular basis.

Moreover, hardly any information was available in some sections. This shows that the company did not update its online platform with time. This shows the information on specific tradelines was difficult to get.

Besides, the website does not have an online calculator or even spreadsheets. They are important since they refer to various tradelines that the company offers. This is very inconvenient for the users and potential clients. This is because they have to use the conventional way of calling the company’s customer service department. They also need to give them their personal information to get the information that they need. Such information consists of the amount of money it would cost them for a specific tradeline. The entire process is quite backward and haggard, and the users do not have a good enough experience with it.

Also, the website has many mistakes. They include errors relating to the wrongful use of legal terminology. This does not leave a good impression on the users visiting the website for the first time. Becoming aware of false information advertised on the website of the company is not good.

In contrast, the display of the website is very amiable and easy to understand. It directs the users to the relevant information with convenience. The website also pens down personal opinions about the tradelines business. This includes what is doable, what is illegal about buying tradelines. Also, the website talks about the information on the credit score.

Despite the company’s shortcomings with its website, it has maintained an A- score from the Better Business Bureau (BBB). This signifies that the company participates in good business practices. The tradelines it offers to its clients have great credit ratings. People often write reviews about their experience with the company.

Apart from this, the company receives excellent reviews throughout the year. The reviews are from both its current and past customers. Such reviews exhibit the way Superior Tradelines operates.

Although the company does not receive the same amount of reviews as its competitors. But its reviews online are positive, honest, and transparent.

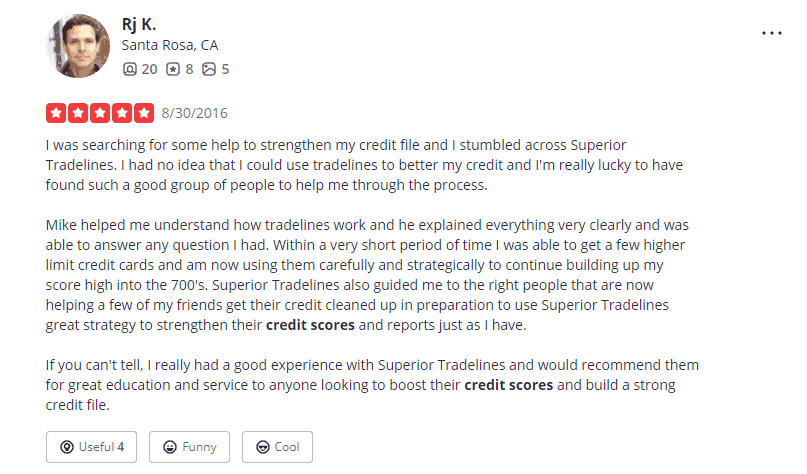

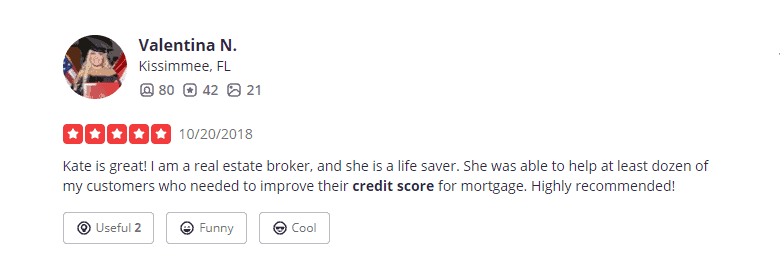

The Positive Superior Tradelines Reviews

On yelp.com, the company has a rating of 4.5/5.0. People express their opinion and experience with the company and its customer service in a candid manner. Some of the examples of such reviews are attached below for reference.

Although the company’s website is not much help and despite the approach the users have to implement to reach the company’s customer service for more information, overall, the clients have had a fairly good experience with the company.

As the reviews suggest, people have benefited from the product and service of Superiortradelines. Hence, it is evident that the company is more apt for those people that can bear with the procedure that the company implements. But, for people who would prefer a simple way to improve their credit score, this tradeline might not be a good fit for them.

Why Choose Superior Tradelines?

The primary reason for choosing this company is:

- They suggest direct and transparent opinions on their website for potential clients seeking to improve their credit score.

- The website offers personal advice on how the company can help people at an affordable rate.

- The website is an imitation of an individual to create a friendly environment and take in the confidence of people that are seeking an immediate solution in improving their credit rating.

- The website provides good and relevant information to make sure that the problem of its clients is resolved promptly.

- The website has a page with a list of frequently asked questions (FAQs) that answer most people who are trying to find a remedy for their credit problem. The FAQs page also answers questions relevant to tradelines that helps people prepare for the process. The information on this page is quite relevant to anyone seeking assistance for credit scores; hence it is transparent about what it can do to help the individuals.

Other Reasons For Choosing Tradelines

At Superior Tradelines, the cost of buying a tradeline is certainly not the cheapest relative to other companies within the industry. Still, the company is honest about giving its client the best service at a decent and fair price. Each tradeline has a different price, so clients choose according to their needs.

Besides, the company has a refund policy that does not appear on the client’s credit report. This highlights the fact that the company is taking certain steps as a sign of good faith for its customers. This is to ensure loyalty and faithfulness. Also, such an act relaxes the minds of certain prospective customers that might still have a doubt about the company.

It offers a free, face-to-face strategy session before a potential client buys or sells tradelines from or to the company. In this way, the customers have a chance to talk it out with the company’s customer service about possible solutions. With a little guidance from the company, the customer can make a decision themselves.

Superior Tradelines always encourages to avail the free in-person consultation for greater insight. The free consultation provides valuable information and knowledge. Such a generous act from the tradeline highlights the significance of how the company takes each customer experience.

The company, superiortradelines, believes that information on tradelines is important for clients. The customers need to know how a tradeline works. The reviews often help but the free consultation offers a much better picture. That is why the company is invested in offering free tradelines information seminars.

One more reason why people prefer Superiortradelines is due to the various opportunities it offers. Such opportunities for clients to learn, grow. And also to be familiar with the tradelines and credit scores. Hence, apart from the company website, they have a blog and YouTube channel. This can help prospective clients learn more about tradelines.

There are several videos on YouTube that can provide a basic understanding of what tradelines are. Also, the blog of the company provides a greater amount of time-sensitive information on tradelines that are quite helpful for both current and future customers.

How Can It Help The Customer’s Credit History?

The basic understanding of how Superior Tradelines can help any customer is the same, i.e., improving the client’s credit score.

Due to the fact that the company has tradelines with a good reputation of having a greater credit score, having access to a reputable tradeline from the company will greatly impact and help the customers in the following ways:

Increase the probability of getting approval for the loan

A larger proportion of people that are granting loans, like financial institutions that include banks, will probably run a credit check to understand the financial situation of a customer in regards to their credit score before giving them the approval for the loan. In a case where the credit score comes out to be low and if the customer has an inadequate credit history of being granted a loan, then indulging a tradeline with a history of positive credit line to the credit profile would substantially increase the chances of getting approval for the loan.

Obtain a lower interest rate

Lenders calculate the interest rate on the basis of how much risk a borrower is prone to. In such a case, if the borrower has a poor credit score, this emphasizes that the borrower is prone to default on a loan which itself is a risk for the lender. But if the credit profile of the borrower is strong and they have a high credit score, then they will receive the loan at a favourable rate, unlike before. As a result, buying a tradeline with a high credit rating guarantees that the borrower will be charged at a lower interest rate.

Buying an apartment/house

In the situation where a customer is seeking to invest in a real estate property, the owner or landlord would be tempted to run a check on the client’s credit profile in order to make sure that they are financially stable and can pay their mortgage payments. Hence, having a tradeline from a company that offers to help its clients at a decent rate would be advantageous in making sure the client is able to buy the property without any inconvenience.

Advancement in career and professional life

The latest trend has developed where employers would like to run a check on the potential employee they are hiring to make sure that they are trustworthy and can handle the workload in the business or financial industry. Running a credit check would paint a picture to the employers on how well a job is carried out in handling personal finances. So it is advised to always have a tradeline with a great credit score to get the employee past the hiring stage and help them move up the corporate ladder.

Obtain better insurance rates

Having a poor credit history can upsurge the insurance of a car, for example. This is because people that have a bad credit score are more likely to file for claims. Having a higher insurance rate means that a person has to pay a greater amount of money to keep his car from being confiscated by the insurance company. And in order to prevent any inconvenience, such people can buy a tradeline. This is where Superior Tradelines come in. With a decent rate and a good credit rating for a tradeline, those people can improve their credit status, thus lowering the insurance rate.

Conclusion

Despite having several companies in the industry that are offering tradelines, Superior Tradelines can be a relatively good choice to choose from if a person is looking to improve their credit score promptly for reasons that can include investment in real estate and to be granted a loan.

Although tradelines are a short-term solution to an imminent problem, they help alleviate the immediate burden that people face.

In an industry where companies are trying to find a competitive edge over other companies, superiortradelines have kept their foot on the ground attracting customers with their transparent and honest views on how they can be of assistance.

So it is safe to say that choosing Superior Tradelines would be a safe bet for people looking for solutions to their credit problem. For further clarification, yelp.com can be visited where current and past client’s experiences could be reviewed. Several clients considered it as a great company with supporting staff members in the customer care department always there to offer assistance for their prospective customers.

Hence, the company’s dealing with the clients and the customer’s experience with Superior Tradelines is what makes the company a safe haven for people looking to upsurge their credit score, and that too from a trustworthy and reliable source.